Insurance fees can rack up quickly. The SafeWork System saves employee health and delivers reduced insurance spend in the process.

The modern workplace costs a lot of money to maintain. Between utilities, taxes, damaged goods and so much more, it adds up quickly. So when employees are injured on the job, an unnecessary addition is thrown into the equation.

Obviously, there are ways to mitigate this loss. For example, insurance. In order to avoid hefty worker’s compensation fees, organizations invest in insurance providers that offer to take on this risk for them. The trade off, in turn, are insurance fees.

While cheaper than workers’ compensation claims, insurance fees are by no means cheap, costing organizations hundreds of thousands of dollars every year, depending on the size of their operation. Then, in the case that an employee is hurt, these fees go up.

Increasing insurance fees, on top of the other, often overlooked costs of a work-related injury (the added cost of days lost, plus hiring and training a replacement are not covered by insurance), mean that every bad bend, every back injury, every dangerously low shelf and so on, is costing you money. So if it wasn’t already, employee health should be a top priority. To not only protect everybody’s livelihoods, but your wallet as well.

How the SafeWork System cuts down Insurance Fees.

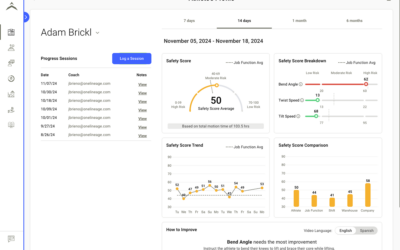

StrongArm’s SafeWork System is designed with your wallet in mind. The SafeWork System is an end-to-end risk management solution, combining state-of-the-art wearable technology, real-time data collection and robust data analytics to provide users and leaders with personalized safety insights and intervention opportunities.

In short, it is the future of injury prevention programs, centered around the idea of keeping every Industrial Athlete proud, protected and productive.

At surface level, StrongArm’s safety solution is already cutting down spending. Once a customer is past the upfront costs, the SafeWork System delivers returns through a number of facets related to injury reduction – an average ROI of 250%. By reducing work-related injuries by as much as 52%, the SafeWork System cuts down on all costs, transparent or hidden, surrounding injuries.

This is how StrongArm fits into the insurance landscape. As a rippling effect of these savings, insurance fees are cut down. Insurance providers are just as excited, if not more, by strong and consistent injury reduction because it means that they pay less in claims as well.

By reducing injuries, insurance providers pay less workers’ compensation claims, operations pay less insurance fees, and employees’ livelihoods are preserved in the process – everybody involved does well by doing good.

StrongArm’s Insurance Footprint

With StrongArm’s Digital Loss Control – where real time Industrial Athlete ergonomic data is leveraged to mitigate workplace injuries and reduce the total cost of risk with digital loss control solutions, insurance carriers, as well as their clients, stand to save a lot of money. That’s why we’re partnered with a number of these carriers to develop risk adjusted pricing and tech enabled risk selection for insureds in the StrongArm connected Industrial Athlete ecosystem.

For example, AXA XL seeks technology partners who share their vision of protecting their clients’ people, projects and profits. In partnering with StrongArm, they help their clients invest in the safety and wellbeing of their most valuable assets — their people — through its leading-edge safety technology fueled by the world’s largest industrial data set.

That’s why they facilitate initiatives with companies like Waste Pro, their customer and ours in a money-saving, people-saving partnership.

Our partnerships with Zurich, The Hartford, Captive Resources and AXA XL deliver reduced claims for the insurance providers, and reduced fees for their clients. And at the bottom line, ensure more Industrial Athletes are sent home safe.

Learn more about our expansion into insurance.